zetflix-mirror.ru Community

Community

Long Term Triple Net Lease

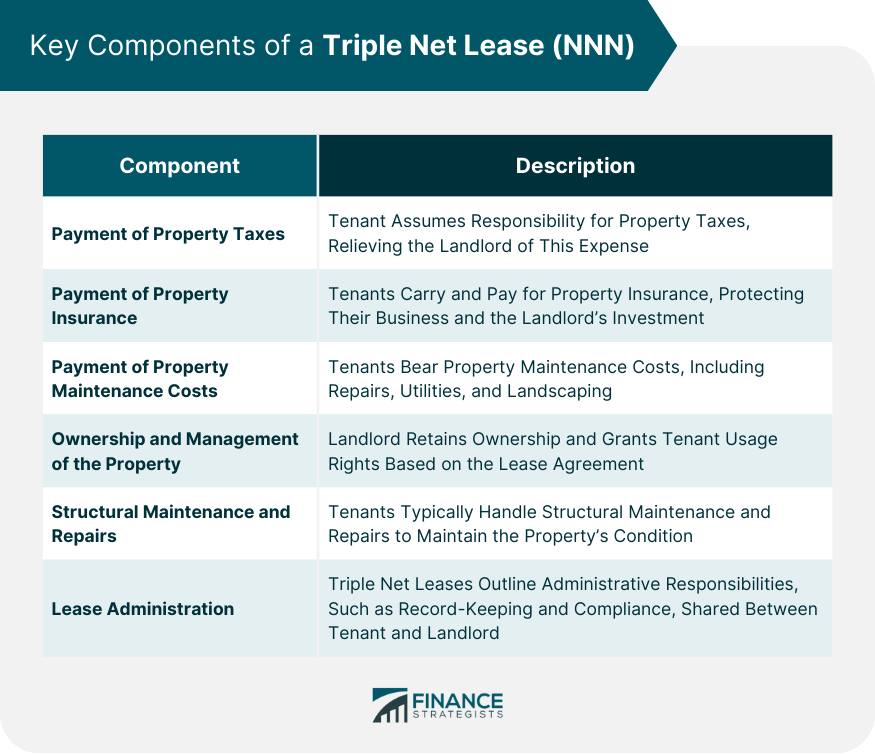

A Triple Net Lease (NNN) is a lease agreement where, apart from paying the rent, the tenant also pays for all operating expenses. Triple net leases, commonly referred to as NNN leases, is a lease structure where the tenant is responsible for property costs usually assigned to the landlord. Triple Net Leased Properties (“NNN”) are properties leased to tenants, typically a single tenant, who is responsible for all of the operating expenses of the. With a triple net lease, the business tenant is responsible for most costs, including the base rent, property taxes, insurance, utilities and maintenance. This. Triple Net Leased Properties (“NNN”) are properties leased to tenants, typically a single tenant, who is responsible for all of the operating expenses of the. A triple net leased investment might be a great alternative for real estate investors looking for long-term, predictable cash flow with minimal danger of. Rollover costs: Triple net leases are typically long-term because of the level of risk the property owner incurs if a tenant leaves. If a. Triple Net Lease definition In a Triple Net Lease, the tenant bears the cost of the three major expenses of property management: net real estate taxes, net. The triple net lease (NNN) passes the costs of structural maintenance and repairs to the tenant in addition to rent, property taxes, and insurance premiums. A Triple Net Lease (NNN) is a lease agreement where, apart from paying the rent, the tenant also pays for all operating expenses. Triple net leases, commonly referred to as NNN leases, is a lease structure where the tenant is responsible for property costs usually assigned to the landlord. Triple Net Leased Properties (“NNN”) are properties leased to tenants, typically a single tenant, who is responsible for all of the operating expenses of the. With a triple net lease, the business tenant is responsible for most costs, including the base rent, property taxes, insurance, utilities and maintenance. This. Triple Net Leased Properties (“NNN”) are properties leased to tenants, typically a single tenant, who is responsible for all of the operating expenses of the. A triple net leased investment might be a great alternative for real estate investors looking for long-term, predictable cash flow with minimal danger of. Rollover costs: Triple net leases are typically long-term because of the level of risk the property owner incurs if a tenant leaves. If a. Triple Net Lease definition In a Triple Net Lease, the tenant bears the cost of the three major expenses of property management: net real estate taxes, net. The triple net lease (NNN) passes the costs of structural maintenance and repairs to the tenant in addition to rent, property taxes, and insurance premiums.

What Is Triple Net Leasing? A net lease is an agreement wherein a tenant agrees to take on not only rent payments, but also operating expenses. These operating. In a triple net lease, the tenant is responsible for property taxes, insurance, and maintenance. This places the burden and unpredictability that can attend all. A triple net lease (NNN) assigns sole responsibility to the tenant for all costs relating to the asset being leased, in addition to rent. Triple net lease (NNN) is normally a commercial lease where the lessee pays rent and utilities as well as three other types of property expenses. The three most common expenses charged back are property taxes, insurance, and maintenance, often called the "three nets". A triple net lease that includes the. Double-Net ("NN") and Triple-Net (or "NNN") leases are leases whereby the tenant is responsible for all operating expenses, including taxes, insurance, the. Under a triple-net lease, the tenant assumes the financial burden of these additional costs, allowing the property owner to transfer some of the financial. Rollover costs: Triple net leases are typically long-term because of the level of risk the property owner incurs if a tenant leaves. If a. NNN properties are often comprised of long-term leases, corporate guarantees, and fixed renewals. Most of these are year leases with multiple 5- to year. Triple net leases are unique from other types of commercial investments in that operational costs, taxes, and insurance are typically passed through to the. Double-Net ("NN") and Triple-Net (or "NNN") leases are leases whereby the tenant is responsible for all operating expenses, including taxes, insurance, the. The triple net (NNN) lease is a lease agreement structure where the tenant pays all of the operating expenses for the property. In real estate, "NNN" is an abbreviation for the phrase "triple net lease." At its core, a triple net lease is a type of commercial lease structure that. For example, a triple net lease under which the landlord performs all building maintenance and repair work at the expense of tenants represents a kind of cost-. Triple Net Lease: The base rent for this type of lease is relatively lower than the full-service lease. However, the tenant still has to pay their pro-rata. Investing in property that is leased to credit tenants on a long-term, triple-net basis is an intelligent way to preserve capital, while receiving steady cash. The major reason why tenants prefer triple net lease structures is that they can be sure of a long term of leasing period which means great stability and. long-term lease, no landlord duties, and the tenant pays for all of the utilities and expenses. Plus, there is potential for rent increases every five years. long as Landlord does Tenant's monthly Base Rent shall be $ per rentable square foot per year of the Premises, triple net during the Lease Term. Long-Term Lease Duration: NNN Leases typically have longer lease durations compared to standard commercial leases. Landlords should carefully consider the.

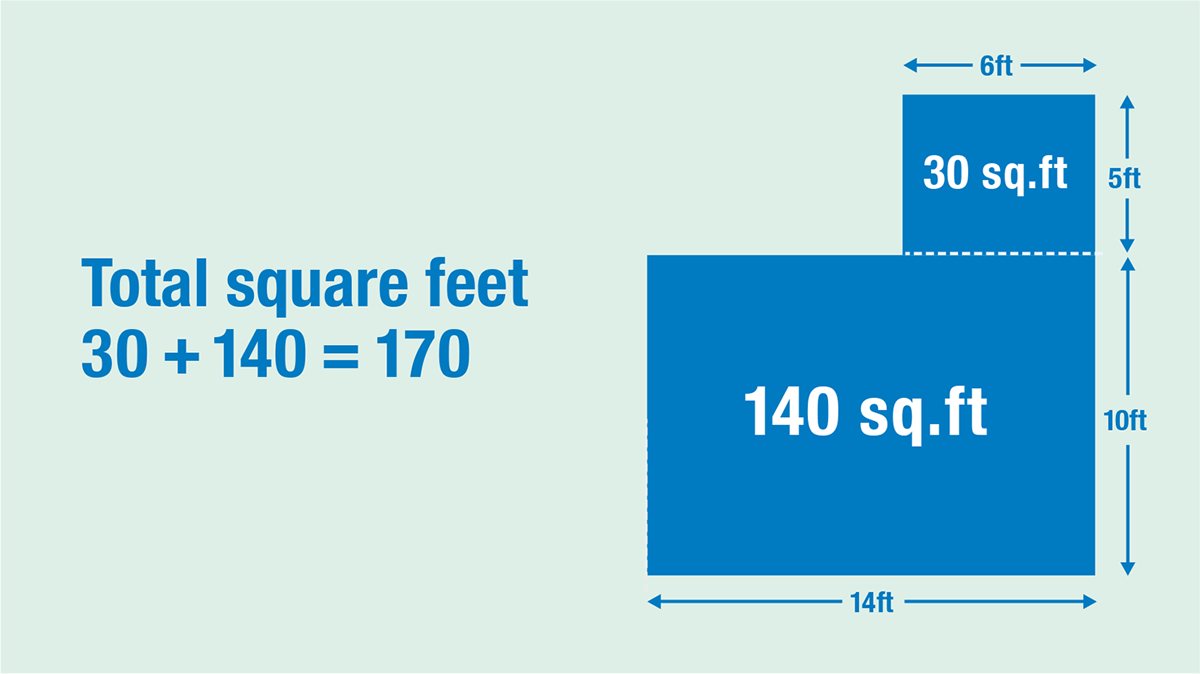

How To Figure Up Square Ft

Square Footage Calculator · Length (ft) x Width (ft) = Total Square Feet · x (Diameter (ft)/2)^2 = Total Square Feet · 1/2 x Length of Side 1 (ft) * Length. Our square foot calculator helps you find the area of a home, building, construction area, and garden in square feet, square meters, and square yards. This free calculator estimates the square footage of a property and can account for various common lot shapes. Every property is different. Knowing the square footage of your yard tells you how much water, fertilizer, or grass seed you will need to maintain it. To calculate the square footage of a square or rectangular area, multiply the length by the width (or height) measurement. This multiplication is done using the. Here's how to calculate square footage of your glass, when using inches. First, measure the length and width of your glass in inches. Then, multiply these two. Convert any inches to fractional feet. Then multiply. For example: 12 ft 6 inches = feet 8 ft 9 inches = feet that rooms area is. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. This calculator is here to help you. To get started, measure the dimensions of the room where you will be installing your new flooring. Square Footage Calculator · Length (ft) x Width (ft) = Total Square Feet · x (Diameter (ft)/2)^2 = Total Square Feet · 1/2 x Length of Side 1 (ft) * Length. Our square foot calculator helps you find the area of a home, building, construction area, and garden in square feet, square meters, and square yards. This free calculator estimates the square footage of a property and can account for various common lot shapes. Every property is different. Knowing the square footage of your yard tells you how much water, fertilizer, or grass seed you will need to maintain it. To calculate the square footage of a square or rectangular area, multiply the length by the width (or height) measurement. This multiplication is done using the. Here's how to calculate square footage of your glass, when using inches. First, measure the length and width of your glass in inches. Then, multiply these two. Convert any inches to fractional feet. Then multiply. For example: 12 ft 6 inches = feet 8 ft 9 inches = feet that rooms area is. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. This calculator is here to help you. To get started, measure the dimensions of the room where you will be installing your new flooring.

BYJU'S online square footage calculator tool makes the calculation faster, and it displays the square footage in a fraction of seconds. Steps to Calculate Square Feet · Measure the length and width of the area. · Convert these measurements to feet if they aren't already. · Multiply the length in. [(Depth in inches + 1 ½ inches) x length in inches] ÷ = Square Footage Needed; Example (from above): ( Use this square footage calculator to easily calculate the area of a rectangular room or a room with a more complex shape. To find the square feet of a room, multiply the length of the room by the width of the room. The length and width can be found by measuring the distance between. Use this square footage calculator to calculate siding square footage or any other square feet needed (like: roofing, carpet, etc.). If your yard is rectangular or square, measure the length and width and multiply them together (length X width = square footage). For example, if your yard has. Multiply the length of the first space by the width of the first space. To find the square footage -- or the area -- of the space, just multiply the length. To get a rough estimate of the amount of square footage of flooring that you will need for that room, multiply the length of the room by the width of the room. All you need to do is multiply the length of the room by the width of the room. From example, if a room is 10 feet wide and 15 feet long, you would multiply To calculate the square feet area of a square or rectangular room or area, measure the length and width of the area in feet. Then, multiply the two figures. To measure a home's square footage, sketch a floor plan of the interior. Break down the sketch into measurable rectangles. Go through the house measure the. Measure length of each wall including doors and windows. Find the total square feet of the wall(s) by multiplying ceiling height by total wall length. Subtract. It's easy. Follow these steps. Measure the length in feet, Measure the width in feet. Multiply the length figure by the width figure. This will be your total. Use our square footage calculator to help you estimate the amount of material you may need for your project. If your lot is feet deep and feet wide*, simply multiply X = a total of 13, square feet. Then subtract from this total the square footage. The square footage calculation is simple. All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation. (For example, 40 feet x 30 feet = 1, square feet.) Next, multiply the area by your roof's pitch. (1, x = 1, square feet.) To allow for hips. To measure square feet of a house in India, you will need a measuring tape and a calculator. Step 1: Measure the length and width of each room. Simply take the length and multiply it by the width. Example: If your length is 3' and your width is 5' 3 X 5 = 15 square feet.

Best App For Logging Hours

Navigation · DeskTime · ProofHub · Hours TimeLord · Timecamp · Time Doctor · Toggl. Hubstaff; Tick; RescueTime; Harvest; Qbserve; Clockify. Timely; QuickBooks. Looking for an online time clock? OnTheClock is a Simple and Powerful app with PTO, scheduling and more. Our time clock has a star customer rating. I can recommend you an app called "Hourlytics: Mindful Logging". It tracks time and has analytics to show you where your time went for the day. Open Time Clock is an online free time clock software, time tracking app that manages employee time & attendance for payroll processing & client project. The Best Time Tracking Apps: 1. My Hours, 2. Timely, 3. Scoro, 4. QuickBooks Time, 5. Harvest, 6. Replicon. In short a great start for any project manager. Effortlessly log your work hours with our work log software. My Hours “Best time tracker app out there”. "My Hours does everything I need it to do. Modern time tracking software, like Insightful, helps you optimize workflows, analyze productivity trends, manage projects and resources, and so much more. Hours TimeLord is the go-to time tracker for individuals and teams who log tasks and billable hours. Download our Time Tracking app today! Timely's AI-powered time tracking software helps teams track their time accurately to report client, project, and work hours easily. Navigation · DeskTime · ProofHub · Hours TimeLord · Timecamp · Time Doctor · Toggl. Hubstaff; Tick; RescueTime; Harvest; Qbserve; Clockify. Timely; QuickBooks. Looking for an online time clock? OnTheClock is a Simple and Powerful app with PTO, scheduling and more. Our time clock has a star customer rating. I can recommend you an app called "Hourlytics: Mindful Logging". It tracks time and has analytics to show you where your time went for the day. Open Time Clock is an online free time clock software, time tracking app that manages employee time & attendance for payroll processing & client project. The Best Time Tracking Apps: 1. My Hours, 2. Timely, 3. Scoro, 4. QuickBooks Time, 5. Harvest, 6. Replicon. In short a great start for any project manager. Effortlessly log your work hours with our work log software. My Hours “Best time tracker app out there”. "My Hours does everything I need it to do. Modern time tracking software, like Insightful, helps you optimize workflows, analyze productivity trends, manage projects and resources, and so much more. Hours TimeLord is the go-to time tracker for individuals and teams who log tasks and billable hours. Download our Time Tracking app today! Timely's AI-powered time tracking software helps teams track their time accurately to report client, project, and work hours easily.

We natively embed our controls into the most popular project management apps for less tab switching · Asana time tracking · ClickUp time tracking. See total time. Work Log is a quick, easy and free way to keep track of your shifts and calculate the number of hours worked and wages earned over your pay period. % Free Online Time ClockEmployee Scheduling. Time Tracking. Task Management. Payroll Reporting. · Great Businesses Rely on Time Clock Wizard · Your Best Choice. Hubstaff offers a time and GPS tracking iOS app that allows time tracking while on-the-go. We have GPS and location monitoring built in with. Work Log is a quick, easy and free way to keep track of your shifts and calculate the number of hours worked and wages paid over your pay period. Clockify is a time tracker and timesheet app that lets you track work hours across projects. Unlimited users, free forever. Replicon's Free Time Tracking Software provides an all-in-one solution for Project Time Tracking, Time Attendance & Professional Services Automation. Best time-tracking apps for freelancers · Clockify · Toggl · Timely · RescueTime · Harvest · My Hours · TrackingTime · Hubstaff; Upwork . 1. Harvest makes it easy to track time across all your projects. Then turn that data into reporting or invoices. Step 1: Set up your project. Add projects, tasks. ClickTime helps organizations plan and account for the time, costs, and revenue associated with their projects. Modern time tracking software, like Insightful, helps you optimize workflows, analyze productivity trends, manage projects and resources, and so much more. “The best free time tracking app” Learning to use Toggl is a breeze, because it's highly intuitive and simple. It ushers you along quickly so that you get. Timeclock is the best solution for tracking employees time from anywhere · Web-based Time and Attendance Software · Time tracking mobile app · Time tracking. Timing saves you time by automatically tracking your time. It logs apps, websites, and documents. It can also help you bill time and still do start/stop. Use Apploye, the best work hour tracker that let you keep track of hours worked. Track work hours, bill clients, manage timesheets, and calculate payroll based. Clockify is the most popular free work timer app that lets you and your team track how much time you spend on tasks and activities. average rating. . Tick's straightforward time tracking software and mobile apps help you track your time Tick tracks your time against your budgets, giving you the best. Reach peak team efficiency with Hubstaff's productivity tools for fully remote, hybrid, or in-office setups without compromising privacy. Clean, lightweight. The 15 overall best employee time-tracking software · Buddy Punch stands out for its ease of use, affordability, and comprehensive features that are suitable. "Track it Forward has been a great asset for our organization! It's easy.

Should I Invest In Municipal Bonds

Before investing in a municipal bond, an investor should carefully review the information available about the bond. Key sources of information, all of which are. As a result, the composition of the U.S. investment-grade corporate bond market changed dramatically—as of July. 31, , over 55% of the U.S. investment-grade. 1. Muni bonds tend to be high-quality investments. · 2. Munis currently have a favorable supply/demand balance. · 3. Muni bonds can help diversify your portfolio. The primary feature of municipal bonds that causes them to be very popular with investors is the potential for all the interest of the bond to be tax free. 1. Muni bonds tend to be high-quality investments. · 2. Munis currently have a favorable supply/demand balance. · 3. Muni bonds can help diversify your portfolio. source of payment for the bonds, you should consider. (among other things): n Credit ratings are not invest- ment advice, guarantees of credit. This refers to the risk that investors won't find an active market for the municipal bond, potentially preventing them from buying or selling when they want and. Just keep in mind that buying municipal bonds is low-risk, but not risk-free, as the issuer could fail to make agreed-upon interest payments. Credit quality varies more with revenue bonds compared to GO bonds, but they can be an attractive option for muni investors looking to round out a diversified. Before investing in a municipal bond, an investor should carefully review the information available about the bond. Key sources of information, all of which are. As a result, the composition of the U.S. investment-grade corporate bond market changed dramatically—as of July. 31, , over 55% of the U.S. investment-grade. 1. Muni bonds tend to be high-quality investments. · 2. Munis currently have a favorable supply/demand balance. · 3. Muni bonds can help diversify your portfolio. The primary feature of municipal bonds that causes them to be very popular with investors is the potential for all the interest of the bond to be tax free. 1. Muni bonds tend to be high-quality investments. · 2. Munis currently have a favorable supply/demand balance. · 3. Muni bonds can help diversify your portfolio. source of payment for the bonds, you should consider. (among other things): n Credit ratings are not invest- ment advice, guarantees of credit. This refers to the risk that investors won't find an active market for the municipal bond, potentially preventing them from buying or selling when they want and. Just keep in mind that buying municipal bonds is low-risk, but not risk-free, as the issuer could fail to make agreed-upon interest payments. Credit quality varies more with revenue bonds compared to GO bonds, but they can be an attractive option for muni investors looking to round out a diversified.

Municipal bonds help finance bridges, schools, hospitals and other projects to improve our communities. Investing in municipal bonds can provide investors with. Even for buy-and-hold investors, there could be tax advantages to selling some munis at a loss and replacing them with similar bonds. A year muni bond. Investors favor municipal bonds, or "munis," for two main reasons. They are exempt from federal taxes, and they are relatively low-risk investments. Investing in municipal bonds is a good way to preserve capital while generating interest. Most of them are exempt from federal taxes, and some are tax-free. Credit quality varies more with revenue bonds compared to GO bonds, but they can be an attractive option for muni investors looking to round out a diversified. Municipal bonds are often considered a safe investment; however, the return of principal and interest is not guaranteed. In fact, some municipal bonds, such as. Should I invest in municipal bonds? The answer to this depends on your current financial situation and your future financial goals, but municipal bonds are. You should strive to diversify your fixed-income investments by issuer and category. Owning bonds from a variety of issuers can help reduce overall risk. Work. municipal bond investing. - Municipal Income - State Fund. Prospective investors should consult with a tax or legal advisor before making any investment. Your Baird Financial Advisor may have access to other sources of information as well. Key Features and Characteristics about. Municipal Bonds. Before buying a. In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. Redeploying assets into a combination of one or more municipal bond funds may generate an equivalent amount of income that is not subject. Municipal bonds are often considered a safe investment; however, the return of principal and interest is not guaranteed. In fact, some municipal bonds, such as. Municipal bonds, when purchased at a discount, may subject investors to capital gains taxes when sold or redeemed. Investors should consult a tax professional. Municipal bonds can help provide a hedge against inflation. Why? Higher prices and incomes create greater revenue from higher property, income and sales taxes. Municipal bonds are gaining traction due to attractive income, low volatility and diversification. Learn how to keep more what you earn in today's market. Just keep in mind that buying municipal bonds is low-risk, but not risk-free, as the issuer could fail to make agreed-upon interest payments. Your Baird Financial Advisor may have access to other sources of information as well. Key Features and Characteristics about. Municipal Bonds. Before buying a. Redeploying assets into a combination of one or more municipal bond funds may generate an equivalent amount of income that is not subject. What are the benefits of investing in muni bonds? · Munis can provide tax-free income at the federal level and may be exempt from state and local taxes as well.

Choosing First Credit Card

Knowing the benefits, fees, charges and interest rates will help you choose the type of credit card that best suits your needs. If you're carrying some credit card debt already and want to transfer your balance, a low interest/low fee card is the best choice for you. The same holds true. What do I need to provide when applying for a credit card? · Proof of income (pay stubs) · Social security number · Valid ID or Passport · Co-signer agreement . When looking for your first credit card, a little research goes a long way. We explain what you need to know with tips to help you compare and choose. on your first $1, in combined eligible purchases each quarter with two retailers you choose. 3% cash back on your first $1, in eligible purchases. Credit builder cards, designed for people with poor or limited credit histories, are a popular choice for first time card holders, particular among young people. The easiest card to get will depend on your credit score and history. Those with excellent credit will find most cards easy to get. Those who don't will have an. Many types of credit cards could be well-suited to become your first. Your pick should be based on what you want from a credit card — transferable points. The first step in determining the best credit card to apply for is to figure out where you stand credit-wise. There are credit cards available for people who. Knowing the benefits, fees, charges and interest rates will help you choose the type of credit card that best suits your needs. If you're carrying some credit card debt already and want to transfer your balance, a low interest/low fee card is the best choice for you. The same holds true. What do I need to provide when applying for a credit card? · Proof of income (pay stubs) · Social security number · Valid ID or Passport · Co-signer agreement . When looking for your first credit card, a little research goes a long way. We explain what you need to know with tips to help you compare and choose. on your first $1, in combined eligible purchases each quarter with two retailers you choose. 3% cash back on your first $1, in eligible purchases. Credit builder cards, designed for people with poor or limited credit histories, are a popular choice for first time card holders, particular among young people. The easiest card to get will depend on your credit score and history. Those with excellent credit will find most cards easy to get. Those who don't will have an. Many types of credit cards could be well-suited to become your first. Your pick should be based on what you want from a credit card — transferable points. The first step in determining the best credit card to apply for is to figure out where you stand credit-wise. There are credit cards available for people who.

We choose from of the top travel and cash rewards credit cards based on your spending habits and lifestyle. Find the best credit card offers and apply today. If you choose to get a card, make sure it's because you've given the matter some serious thought first. Don't sign up because you're offered a number of. Just choose Apple Card Monthly Installments and then check out. Your Apple Card is the first consumer credit card Goldman Sachs has issued, and. How to apply for a credit card · 1. Compare all your borrowing options first · 2. Check your credit reports are up to date and error-free · 3. Use eligibility. Checklist of what to look out for when choosing a credit card · Annual Percentage Rate (APR). This is the cost of borrowing on the card, if you don't pay the. Get the personal credit card that is right for you by choosing from one of our two available options. You'll earn credit card rewards with points for every. Choosing the right credit card is easier than ever. Whether you want to The freedom to choose and the power to earn. 5% cash back on first $2, of. Certain types of cards can help you build credit if you're just starting out, or they can help you rebuild credit if you've had a financial setback. As you use. With 0% APR for the first 12 months and no annual fee, choosing the right credit card has never been easier. After the intro APR offer ends, a Variable APR that's currently % to % will apply. 3% † Intro balance transfer fee for the first 60 days your account. Consider two credit cards: One carries an 18 percent interest rate, the other 15 percent. If you owed $3, on each and could only afford to pay. $ per. Which credit card is best for me? · 1. Check your credit score · 2. Whittle down your card options · 3. Read the fine print · 4. Apply for the card that best meets. Picking the right credit card with the best features can really help your personal finances, and asking the right questions will help with your decision. The first step is to check your credit score and credit report. There are numerous free resources available, such as CreditWise from Capital One and Discover. The America First Credit Union Visa Platinum Credit Card is designed for you -- literally. You can personalize the image on your card, and you can choose one of. There are three things you should probably consider when looking for a new credit card. First, how's your credit? If you have little or bad credit, your options. Therefore, it's important to know what your spending habits are in order to choose the card that makes the most sense for you. Cardholders who carry a balance. How to get the best credit card for you · Work out how much you can pay off each month · Set a credit limit you can afford · Weigh up the pros and cons of card. How much can I save by transferring my credit card balance? · Current balance · Interest rate · Monthly payment · Annual fee. After the intro APR offer ends, a Variable APR that's currently % to % will apply. 3% † Intro balance transfer fee for the first 60 days your account.