zetflix-mirror.ru Tools

Tools

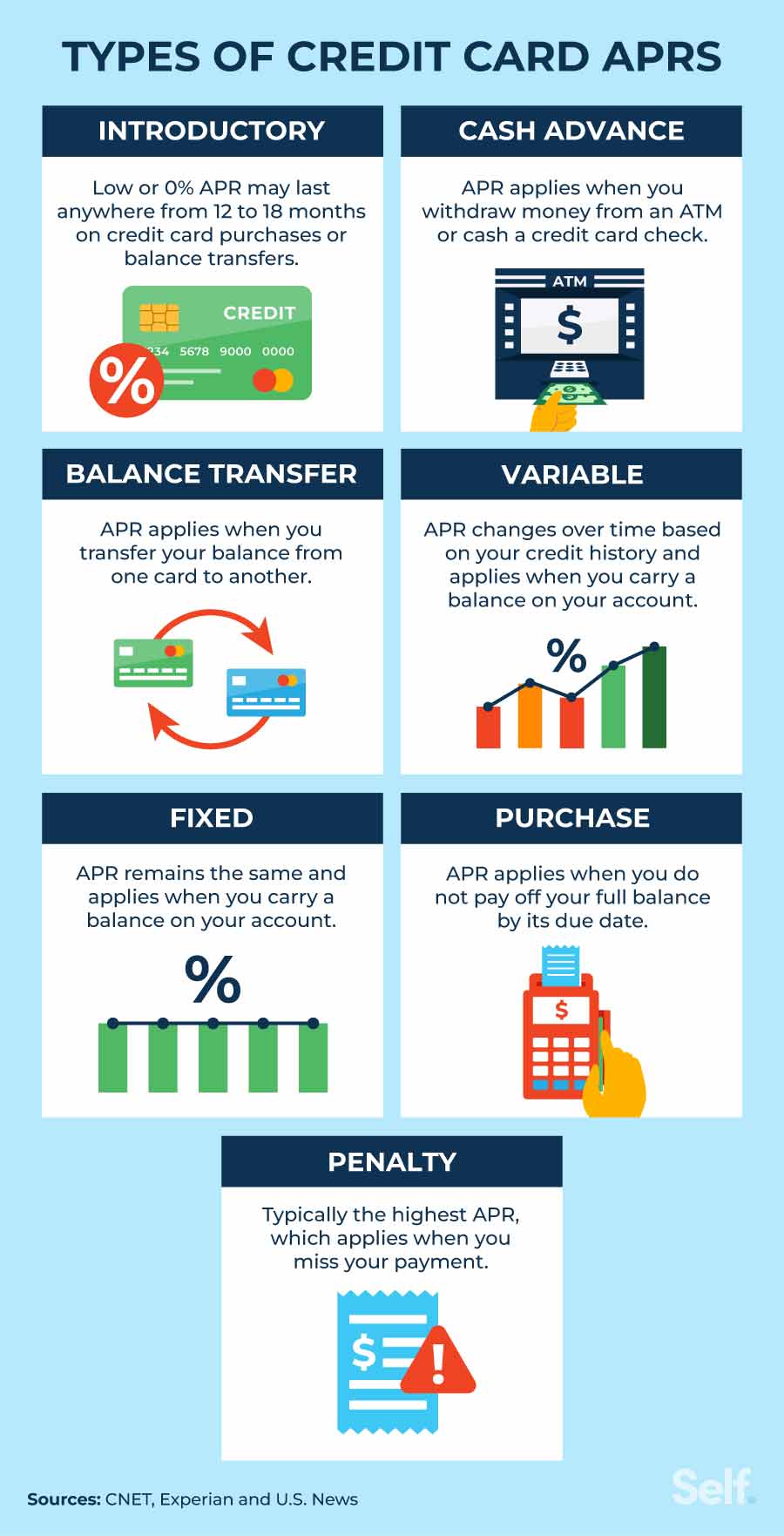

How To Get A Good Apr

Tips to get a lower-APR card · Use your current card responsibly and pay your bills on time. Late payments can have a negative effect on your credit. · Avoid. Find credit cards from Mastercard for people with bad credit. Compare credit cards from our partners, view offers and apply online for the card that is the. An APR is considered to be a good rate when it is at or below the national average, which currently sits at %, according to the Fed. Auto Loan Rates as Low as % APR for New Vehicles. You could get a decision in seconds, plus a discount for active duty and retired military. A lower interest rate may be a better deal. For more information about APR, see Getting the best credit deal. Comparing cards. Key information you should get. An example of calculating APR on a loan. First, add $1, and $ 1. Find the interest rate and charges. For the APR formula, you'll. The lower your personal loan APR, the less money you'll pay in financing costs over the life of the loan. Read more about how to get a good personal loan rate. In most cases, new cars have lower APRs while used cars have higher APRs. Shopping around and comparing loans can help you get the best loan terms for your. Your personal loan APR will be decided based on your credit score, credit history and income, as well as other factors like the loan's size and term. Some of. Tips to get a lower-APR card · Use your current card responsibly and pay your bills on time. Late payments can have a negative effect on your credit. · Avoid. Find credit cards from Mastercard for people with bad credit. Compare credit cards from our partners, view offers and apply online for the card that is the. An APR is considered to be a good rate when it is at or below the national average, which currently sits at %, according to the Fed. Auto Loan Rates as Low as % APR for New Vehicles. You could get a decision in seconds, plus a discount for active duty and retired military. A lower interest rate may be a better deal. For more information about APR, see Getting the best credit deal. Comparing cards. Key information you should get. An example of calculating APR on a loan. First, add $1, and $ 1. Find the interest rate and charges. For the APR formula, you'll. The lower your personal loan APR, the less money you'll pay in financing costs over the life of the loan. Read more about how to get a good personal loan rate. In most cases, new cars have lower APRs while used cars have higher APRs. Shopping around and comparing loans can help you get the best loan terms for your. Your personal loan APR will be decided based on your credit score, credit history and income, as well as other factors like the loan's size and term. Some of.

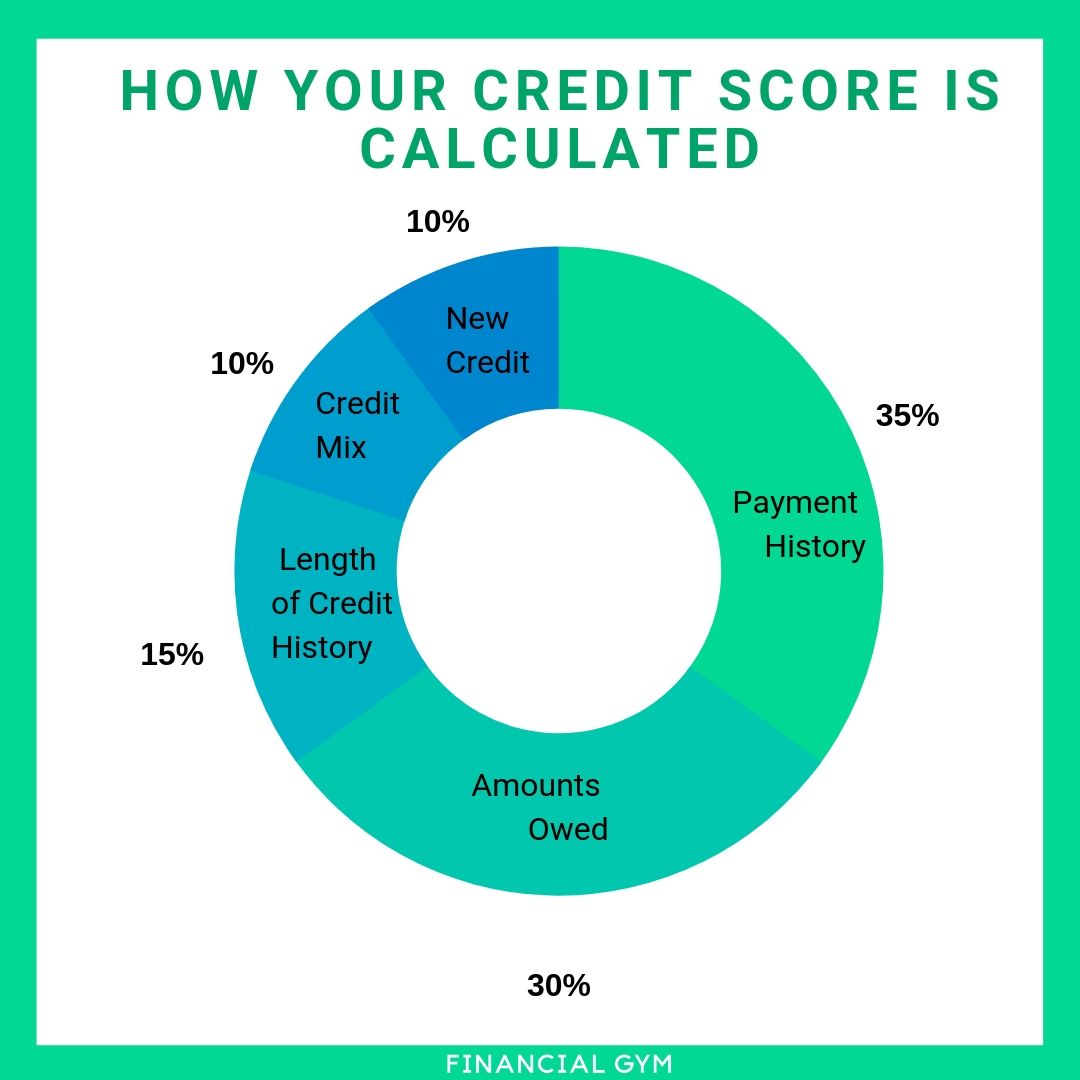

Learn what it takes to achieve a good credit score. Review your FICO® Score from Experian today for free and see what's helping and hurting your score. Get Your. There's no specific Annual Percentage Rate (APR) that's good or bad across all types of loans, but the lower the APR you get offered, the better. Comparing APRs across multiple loans or lenders can help you find the best options for your situation. Annual percentage yield (APY) is similar to APR, but. Your rate is good for 30 days, so you'll have plenty of time to shop for that perfect vehicle. Interest rate discount. Bank of America customers may be. A great APR for a credit card is 0%. The right 0% credit card could help you avoid interest entirely on big-ticket purchases or reduce the cost of existing debt. Your loan approval is good for 45 days, so you can take time to find the best deal on the car you want. New Car Loan. As low as. %A P RAPR. on a month. Renovate your kitchen, pay off high-interest debt, or have A month loan with a % APR would have monthly payments of $ per thousand dollars. If you have excellent credit and you're applying for a barebones credit card, you might find APRs as low as 13%. But, if you have a low credit score, you may be. Not every card we recommend is great for both purchases and balance transfers. Some of our picks feature the same long intro period for both, but others have. Generally, smaller loan amounts and shorter repayment terms tend to have lower interest rates. How to ensure a good APR on your personal loan? Obtaining a. What is a good APR for a car loan with my credit score and desired vehicle? If you have excellent credit ( or higher), the average auto loan rates are An excellent credit score can work in getting you a credit card with a good APR, and the reverse holds true as well. How to qualify for a credit card with a good APR · Check your credit score using Chase Credit Journey · Make your monthly payments on time · Lower your credit. Prequalification is an excellent way to find out if you're able to get a loan and what your estimated costs may be. You can also ask your dealer or lender about. Lenders have a fair amount of authority to determine how to calculate the APR, including or excluding different fees and charges. What Is a Good APR? Home Mortgage: right now (December ) the best rates are under 3% · Personal Loan: 5–8% is pretty decent · Low interest credit cards: I have. You may find some great deals on rates and more depending on your credit score and buying demand. The interest rate environment, of course, also plays a big. PNC auto refinancing may help you improve upon your existing auto loan with a competitive APR and flexible terms. See when you might have the best chance to. If you have excellent credit and you're applying for a barebones credit card, you might find APRs as low as 13%. But, if you have a low credit score, you may be. These offers are a great way to save on interest charges and get out of debt. good credit score () may receive a higher APR. If you have a fixed.

How Much Is First Time Home Buyers Insurance

Putting less than 20% down will typically require you to pay for private mortgage insurance (keep reading for more on that). Closing costs could be about %. Home Buyers Protection Insurance covers the up-front costs associated with buying a house, from the cost of your solicitor to mortgage arrangement fees. Whether. How much does New Home Buyers Insurance Cost? The cost of home insurance for first-time homebuyers varies widely based on numerous factors. The national. Common Homeowners Insurance Discounts. New Homes may enjoy discounts of up to 14%. Security Systems such as deadbolt locks, simple alarm systems, and smoke. No down payment required · Low mortgage rates · % financing · Reduced monthly mortgage insurance · Closing costs can come from a gift · Easy to qualify for. Home sweet Ontario: your journey on how to buy a home. couple buying a home. Buying a house is one of the most significant financial decisions you will make in. Replacement cost is the cost to rebuild your home with similar type and quality materials. You'll want to be sure that this amount is enough to cover a total. I have a sqft new construction house in Philadelphia proper, purchase price was $, in and I'm currently paying $/month. Shopping for your dream house? There are many considerations when looking at real estate, like property taxes, school district, the appeal of the. Putting less than 20% down will typically require you to pay for private mortgage insurance (keep reading for more on that). Closing costs could be about %. Home Buyers Protection Insurance covers the up-front costs associated with buying a house, from the cost of your solicitor to mortgage arrangement fees. Whether. How much does New Home Buyers Insurance Cost? The cost of home insurance for first-time homebuyers varies widely based on numerous factors. The national. Common Homeowners Insurance Discounts. New Homes may enjoy discounts of up to 14%. Security Systems such as deadbolt locks, simple alarm systems, and smoke. No down payment required · Low mortgage rates · % financing · Reduced monthly mortgage insurance · Closing costs can come from a gift · Easy to qualify for. Home sweet Ontario: your journey on how to buy a home. couple buying a home. Buying a house is one of the most significant financial decisions you will make in. Replacement cost is the cost to rebuild your home with similar type and quality materials. You'll want to be sure that this amount is enough to cover a total. I have a sqft new construction house in Philadelphia proper, purchase price was $, in and I'm currently paying $/month. Shopping for your dream house? There are many considerations when looking at real estate, like property taxes, school district, the appeal of the.

FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums . Federal Housing Administration (FHA) Mortgages – requires only % down, and all of the funds can be a gift from a relative. Ohio Housing Financing Association. Many first time home buyers are ill prepared and are forced to exit their mortgage insurance premium which are typically higher mortgage insurance premiums. First-time homebuyer programs can help you turn your dream of owning your first property into a reality. Learn more about Greater Nevada Mortgage's programs. Home insurance costs can vary greatly depending on various factors, including the age, size, and location of your home, and the likelihood of a significant. Buying your first home? We offer a variety of first-time homebuyer tools and resources to help you. Learn what to expect at every step in your journey. With a low down payment, mortgage insurance will be required, which increases the cost of the loan and will increase your monthly payment. Talk with a home. 1. Mortgage insurance · If the home costs $, or less, you'll need a minimum down payment of 5%. · If the home costs more than $,, you'll need a. The average monthly cost for homeowners' insurance is approximately $ to $ monthly or $ to $ annually. While many regions may offer their own incentives, there are three programs that are accessible to most Canadians: Land Transfer Tax Rebate Programs; RRSP Home. Many insurance agencies and/or carriers offer three main types of homeowners insurance policies: a bare-bones policy that covers a handful of circumstances; a. Explore low interest mortgage options. State of New York Mortgage Agency (SONYMA). Low-Cost Home Mortgages. SONYMA loans are designed to make your. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). You need to save for a minimum 5% down payment, qualify for a mortgage and have sufficient money left over for both closing costs (minimum % of the purchase. Additional costs for home buyers. Land Transfer Tax. The home In Canada, home buyers must purchase mortgage loan insurance, also known as. This homeowners insurance calculator from MoneyGeek can help you estimate the cost of a homeowners insurance policy in New York. PMI — Private mortgage insurance, which is usually required for They are a big help to first time Texas homebuyers with bad credit. Here are. VA loans also do not require a down payment, they offer lower interest rates, and have no monthly mortgage insurance premiums. In addition to the federal. Protect your home and belongings with State Farm homeowners insurance. First time homeowners, get details of what you need for a free online quote today. If your down payment is less than 20% of the total price of your home, you'll be required to purchase mortgage loan insurance. If you're self-employed, you may.

Blockchain In Stock Market

Stock market across the globe is rapidly using blockchain technology for the market transaction. Some of the country is still preparing themselves to use the. Cryptocurrency trading involves speculating on price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Here you'. Gain knowledge of the benefits and impact of blockchain in capital markets across the buy side, sell side, and market infrastructure. ranked list of publicly traded Blockchain companies. Find the best Blockchain Stocks to buy. A blockchain, originally block chain, is a growing list of. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. Read on to learn about the seven best blockchain stocks, which are less expensive investment options but still packed with potential. A blockchain is a distributed database or ledger shared among a computer network's nodes. They are best known for their crucial role in cryptocurrency systems. Blockchain is a form of supply/financial chain management. Orders are processed more quickly, payments made more rapidly, and with an indelible computer. Besides investing directly in stocks of companies making use of blockchain, there are other ways to get in on the action. Stock market across the globe is rapidly using blockchain technology for the market transaction. Some of the country is still preparing themselves to use the. Cryptocurrency trading involves speculating on price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Here you'. Gain knowledge of the benefits and impact of blockchain in capital markets across the buy side, sell side, and market infrastructure. ranked list of publicly traded Blockchain companies. Find the best Blockchain Stocks to buy. A blockchain, originally block chain, is a growing list of. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. Read on to learn about the seven best blockchain stocks, which are less expensive investment options but still packed with potential. A blockchain is a distributed database or ledger shared among a computer network's nodes. They are best known for their crucial role in cryptocurrency systems. Blockchain is a form of supply/financial chain management. Orders are processed more quickly, payments made more rapidly, and with an indelible computer. Besides investing directly in stocks of companies making use of blockchain, there are other ways to get in on the action.

In this paper, we focus on blockchain-based securities trading, in which blockchain technology plays a vital role in financial services. Blockchain stocks are a more traditional, conservative way to tap into the rapidly growing blockchain technology, without betting it all on cryptos. The blockchain may be considered a type of payment rail. Private blockchains have been proposed for business use. Computerworld called the marketing of such. Companies in the country are widely adopting the Blockchain technology across several industries such as banking and financial services, transportation, supply. “The blockchain is an incorruptible digital ledger of economic transaction that can be programmed to record no just financial transactions but virtually. Cryptocurrency trading involves speculating on price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Here you'. The blockchain landscape presents an array of investment opportunities, resonating with the dynamism of technology and finance. Blockchain, the foundational. blockchain-based equity trading stock exchange. Korea. Korea Exchange (KRX) KRX has launched a Korea Startup Market (KSM) where equity shares of startup. In this article, we delve into the ten best blockchain stocks to buy, each embodying the innovation and potential of this rapidly evolving domain. How To Invest in Blockchain Technology Stocks The most straightforward way to invest in a blockchain is to buy the associated cryptocurrency. Every time you. Building a Decentralized Stock Market based on Blockchain Technology. Building a decentralized stock market will help eliminate unnecessary intermediaries. List of all blockchain stocks as well as stock quotes and recent news. As blockchain continues to mature, it may not entirely replace stock markets but rather complement and enhance existing financial infrastructure. With a blockchain-based stock market infrastructure, all transactions would be recorded on a public ledger, accessible to all participants in. A stock exchange trades in company stocks or shares, while a cryptocurrency exchange trades in cryptocurrencies (digital currencies), such as Bitcoin, Ethereum. Find the best blockchain Technology Stocks to buy now. Robinhood Markets (HOOD), RIOT (RIOT) and Coinbase (COIN) are some of the most trending stocks in the. IBM isn't just a blockchain stock, but the company is a player in the blockchain market, so it goes on the list. Oracle, and Visa are known to be investing in. It was founded in and is based in Alpharetta, Georgia. Discover the right solution for your team. The CB Insights tech market intelligence platform. Market Insights. / Capital Markets / Digital Assets. Capital Markets. Capital Markets What can you trust in a trustless system: Public blockchains for. SDX is building a robust infrastructure based on DLT blockchain technology to enable the issuance, trading, settlement, and custody of digital assets. By.

Calculating Tax And Ni

The amount you get paid; What you spend on business costs; We work out your Tax and NI figures for you. Our calculator uses standard Tax and NI calculations. Use our simple Salary Calculator to work out your NET wage after PAYE & National Insurance contributions. Enter your estimated weekly or monthly profit to get an idea of how much Income Tax and Class 4 National Insurance you'll pay. The calculator needs some information from you before working out your tax and National Insurance. Firstly, you need to enter the annual salary that you receive. This payslip calculator performs calculations for the /25 tax year on a Month 1 basis. Employees NI: £; Student Loan: £; Net Earnings: £ Use our take-home calculator to work out how much you earn after tax, national insurance, student loan and pension contributions for the current (/22) and. This PAYE/NI calculator will determine which bands your gross salary falls in and tell you how much tax you pay. National Insurance rates if you're self-employed ; £12,£50, Class 4. 6% of profits between £12,£50, ; Over £50, Class 4. 6% of profits between. Key Takeaways. Net income (NI) is calculated as revenue minus expenses, interest, and taxes. Earnings per share (EPS) are calculated using NI. The amount you get paid; What you spend on business costs; We work out your Tax and NI figures for you. Our calculator uses standard Tax and NI calculations. Use our simple Salary Calculator to work out your NET wage after PAYE & National Insurance contributions. Enter your estimated weekly or monthly profit to get an idea of how much Income Tax and Class 4 National Insurance you'll pay. The calculator needs some information from you before working out your tax and National Insurance. Firstly, you need to enter the annual salary that you receive. This payslip calculator performs calculations for the /25 tax year on a Month 1 basis. Employees NI: £; Student Loan: £; Net Earnings: £ Use our take-home calculator to work out how much you earn after tax, national insurance, student loan and pension contributions for the current (/22) and. This PAYE/NI calculator will determine which bands your gross salary falls in and tell you how much tax you pay. National Insurance rates if you're self-employed ; £12,£50, Class 4. 6% of profits between £12,£50, ; Over £50, Class 4. 6% of profits between. Key Takeaways. Net income (NI) is calculated as revenue minus expenses, interest, and taxes. Earnings per share (EPS) are calculated using NI.

How your income tax is calculated. When you're self-employed, you have to pay your income tax and national insurance contributions yourself in your annual Self. See what your take home pay should be with our free income tax calculator. We also have tips on tax codes and what yours means Exclude National Insurance? Use if unsure which is the basic single or married person allowance, full tax code usually being L. Results. Tax deducted (£). Employees NI (£). Net. The amount of wage tax/national insurance contributions you must withhold is based on the bracket rate for the wage tax/national insurance contributions. The Salary Calculator tells you monthly take-home, or annual earnings, considering UK Tax, National Insurance and Student Loan. How is National Insurance (NI) calculated for the Employed? · 1. £50, (2nd slab) - £ (exempt limit) = £40, x 12% (2nd slab NI rate) = £4, · 2. £. Calculate your income tax and National Insurance contributions for the current year at zetflix-mirror.rus in a new window If you live in Wales, your Income Tax rates. SmartAsset's New Jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes. Enter your info to see your take home. The Salary Calculator tells you monthly take-home, or annual earnings, considering UK Tax, National Insurance and Student Loan. Married: Married couples over the age of 65 may have an increased tfa, and do not pay national insurance. Blind: Additional allowance is made available to blind. However, the NI threshold and tax-free personal allowance - the amount you can earn every year before you have to pay income tax - have been frozen at £12, Use ADP's New Jersey Paycheck Calculator to estimate net or “take home” pay for either hourly or salaried employees. Just enter the wages, tax withholdings. Calculation layout ; You are left with the amount of your taxable income on which you have to pay tax. xxxx ; Calculate your tax liability using the tax rates. Unique self-employed income calculator to work out what you need to pay towards your income tax, National Insurance & take home pay. StepChange. This calculator will provide an estimate of how much Income Tax and National Insurance you may pay, based on your earnings. You can also use it to find out. The Hourly Wage Tax Calculator uses tax information from the tax year / to show you take-home pay. See where that hard-earned money goes - with UK. This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of / On a 50, salary per year, your take home salary will be £3, You'll pay £ in income tax, £ in NI contributions and contribute £ Use our sole trader tax calculator to estimate your businesses annual and monthly profits, tax payments, and NI contributions. It's easy with takepayments. Our employed and self-employed calculator gives you an estimated income and national insurance tax bill based on your annual gross salary, self-employment.

Short Selling Etf Funds

Short ProShares ETFs are non-diversified and entail certain risks, including risk associated with the use of derivatives (swap agreements, futures contracts and. Securities and Exchange Commission (). “Short selling is extreme in many ETFs. • We also examine the relationship of ETF FTDs and financial markets. Investors are able to short sell an ETF, buy it on margin, and trade it. In other words, ETFs are traded and exploited like any other stock on an exchange. An ETF is a collection of hundreds or thousands of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges, like the New York. Inverse/Short ETFs seek to provide the opposite return of an index for a single day. This creates an effect similar to shorting an asset class. An inverse ETF generally seeks to deliver the opposite of the daily performance of the index or benchmark that it tracks. Inverse ETFs often are marketed as a. Short selling is when you borrow shares of a stock or other security from your broker and sell them with the goal of buying back the shares at a lower price. These are funds that seek to provide 'short' exposure to the sharemarket. They provide investors with the opportunity to profit from, or protect against. When you short a stock or ETF in the market, you are exposed to that position going potentially infinitely higher. Your portfolio could suffer devastating. Short ProShares ETFs are non-diversified and entail certain risks, including risk associated with the use of derivatives (swap agreements, futures contracts and. Securities and Exchange Commission (). “Short selling is extreme in many ETFs. • We also examine the relationship of ETF FTDs and financial markets. Investors are able to short sell an ETF, buy it on margin, and trade it. In other words, ETFs are traded and exploited like any other stock on an exchange. An ETF is a collection of hundreds or thousands of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges, like the New York. Inverse/Short ETFs seek to provide the opposite return of an index for a single day. This creates an effect similar to shorting an asset class. An inverse ETF generally seeks to deliver the opposite of the daily performance of the index or benchmark that it tracks. Inverse ETFs often are marketed as a. Short selling is when you borrow shares of a stock or other security from your broker and sell them with the goal of buying back the shares at a lower price. These are funds that seek to provide 'short' exposure to the sharemarket. They provide investors with the opportunity to profit from, or protect against. When you short a stock or ETF in the market, you are exposed to that position going potentially infinitely higher. Your portfolio could suffer devastating.

You trade actively. Intraday trades, stop orders, limit orders, options, and short selling—all are possible with ETFs, but not with mutual funds. You're tax. Definition: Inverse Equity ETFs invest in various stock assets. Funds in this category often track indices, but can also build portfolios of specific. leverage, short-selling, short-term trading and investing in derivatives sale of its ETF shares. In addition, for all of the foregoing reasons, the. Short selling allows investors to profit from a potential decrease in the ETF's value by borrowing and selling shares. Shorting an ETF means taking a position that will profit if the price of that ETF falls in value. Short-selling is a strategy you'll use if you have a negative. Investors are able to short sell an ETF, buy it on margin, and trade it. In other words, ETFs are traded and exploited like any other stock on an exchange. Investors purchasing or selling shares of the Fund in the secondary Exchange Traded Funds (ETFs) before investing. To obtain an ETF's prospectus. Short selling involves borrowing a security whose price you think is going to fall and then selling it on the open market. Long/short ETFs often take a relative long bias by investing the proceeds of the fund's short sale to purchase additional shares of securities (e.g., % long. Short sellers pay a fee to the lender so that they can borrow ETF shares to sell in the market and then buy them back later at a lower price to lock in a profit. An inverse ETF, often known as a bear or short ETF, is an exchange-traded fund designed to profit from a market decline. These short-term, publicly traded. Short sales have the potential to expose an investor to unlimited losses, whether or not the sale involves a stock or ETF. An inverse ETF, on the other hand. One strategy to capitalize on a downward-trending stock is selling short. This is the process of selling “borrowed” stock at the current price, then closing. A “short” position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. Ticker, Fund Name, Issuer, AUM, Expense Ratio, 3-Mo TR, Segment. SQQQ, ProShares UltraPro Short QQQ, ProShares, $B, %, %, Inverse Equity: U.S. An inverse ETF, sometimes called a short ETF, seeks to profit when the price of a benchmark falls. These ETFs often use futures contracts, swaps, or other. ETFs trade just like stock; you can buy and sell shares of an ETF throughout the day on an exchange. Definition. ETF cloud ETF funds are not usually actively. The fund invests in a diversified short duration portfolio of fixed-income securities comprised of investment-grade money market and other fixed-income. inverse strategies to profit during or protect a portfolio from declines Short selling, buying put options, selling futures contracts, and using inverse ETFs. Inverse/Short China ETFs seek to provide the opposite daily or monthly return of various broad indexes tied to Chinese stocks. This essentially creates a.

How To Buy Stock On Cashapp

If you would like to sell stock using Cash App Investing, the amount of your sale may be automatically deposited into your Cash App balance. When you buy stock using Cash App Investing, you are limited to 3 day trades within a rolling 5 day trading period. For example: On Monday. Once the account sponsor approves the sponsored person's request to invest in stocks and bitcoin, the sponsored person can start buying stocks in Cash App. The platform enables you to buy stocks or exchange-traded funds (ETFs) with your Cash App balance or a linked debit card. You can also sell the stocks and ETFs. Cash App offers peer-to-peer transactions, direct deposits, a savings account, a debit card, investing in stocks and Bitcoin, a tax filing service, and personal. Cash App made stock trading available so that anybody could invest. Fractional shares of stocks are available for purchase and sale, allowing. Make your first stock purchase using Cash App Investing to open an account. Cash App Investing is available to US residents only. Selling Stock on Cash App · Open the Cash App: Launch the Cash App on your smartphone or tablet. · Navigate to Investing: Look for the "Investing". There is a transfer fee (I believe whenever I did it it was like $75) and your shares will be transferred over within a couple of days. However. If you would like to sell stock using Cash App Investing, the amount of your sale may be automatically deposited into your Cash App balance. When you buy stock using Cash App Investing, you are limited to 3 day trades within a rolling 5 day trading period. For example: On Monday. Once the account sponsor approves the sponsored person's request to invest in stocks and bitcoin, the sponsored person can start buying stocks in Cash App. The platform enables you to buy stocks or exchange-traded funds (ETFs) with your Cash App balance or a linked debit card. You can also sell the stocks and ETFs. Cash App offers peer-to-peer transactions, direct deposits, a savings account, a debit card, investing in stocks and Bitcoin, a tax filing service, and personal. Cash App made stock trading available so that anybody could invest. Fractional shares of stocks are available for purchase and sale, allowing. Make your first stock purchase using Cash App Investing to open an account. Cash App Investing is available to US residents only. Selling Stock on Cash App · Open the Cash App: Launch the Cash App on your smartphone or tablet. · Navigate to Investing: Look for the "Investing". There is a transfer fee (I believe whenever I did it it was like $75) and your shares will be transferred over within a couple of days. However.

Yes, it is legit to buy stocks on Cash App. Cash App offers a feature called Cash App Investing, which allows users to invest in stocks. Navigate to the stock with the active Custom Order; Scroll down to see your active Custom Order; Press the cancel button; Confirm the cancellation. Option 2. Cash App Investing is a part of Cash App's business that allows customers to buy and sell stocks through stock trading activity for one trading day. Once you've identified a stock you want to purchase, tap on it to access more details. Cash App allows you to buy both full and fractional shares. Enter the. If you have an iPhone, the stocks app that comes installed on the device can only be used to view and follow stocks, you're not able to purchase. purchase Bitcoin cryptocurrency and trade stocks through the platform. Cash App makes money by charging transaction fees to businesses and individuals. 3M Followers, 2 Following, Posts - Cash App (@cashapp) on Instagram: "$ send $ spend $ bank $ invest $ Prepaid debit cards issued by Sutton Bank. If you've been intimidated by the process of creating a brokerage account to buy and sell shares of stocks, buying your first share through Cash App can be an. On Cash App, you can invest in over 1, stocks and ETFs (exchange traded funds). We may periodically add more investing options to our platform. Stocks listed. Withdraw it to different wallets, anytime. BUY & SELL STOCKS COMMISSION-FREE. Start investing and buying stocks with as little as $1.*** Track stocks, your. Sending stock · Enter the amount, in USD, of stock you would like to send · Enter the recipient's $cashtag and select “send as” Stock · Search for the stock or. How To Schedule an Auto Invest: · Select the stock you'd like to purchase and tap “Buy” · Tap the drop down menu where it says “Standard One-Time Order”. Go to your Invest tab and select Stocks · Select any of your stock investments and tap Sell · Enter an amount and tap Next · Reconfirm the transaction. Investing Buy Limits. Your Cash App account has limits for trading stock with Cash App Investing. You are limited to $50, of stock purchases in a rolling 7. Yes, Cash App stocks legit. If you want to invest in stocks and Cryptocurrency then you can create a account in Cash App and you can can. Deep Dive · 1. Apple Inc. (NASDAQ: AAPL) · 2. NVIDIA Inc. (NASDAQ: NVDA) · 3. Shopify Inc. (NYSE: SHOP) · 4. Visa Inc. (NYSE: V) · 5. Bank of America Corp. (NYSE. Investing Buy Limits. Your Cash App account has limits for trading stock with Cash App Investing. You are limited to $50, of stock purchases in a rolling 7. ACTUALLY, MADE ME BUY STOCK, I THINK. THEY ARE THE FUTURE OF BANKING AND. MORE so I'm teaming up with @CashApp to give out $1 MILLION in stocks. Searching Stocks · Tap the Money tab on your Cash App home screen · Tap on the Stocks Tile · Tap the search bar · Enter your search query. With Cash App Investing, you can purchase as little or as much of a stock as you want, even if you only want to spend $1.

Sports Management Agent

What is a sports agent? What do sport agents do? Sport agents also search for talented athletes. Their role is different from a coach or scout. Sports agents do. As a sports agent, I understand it is my responsibility to sit down with team owners, advertisers and entertainment personal to secure the best contracts. Our 8-week online Athlete Management Certificate Course prepares you for all parts of life as a sports agent. This course covers everything from signing your. Top 27 Professional Athlete Management Companies · 1. Octagon · 2. Excel Sports Management · 3. Boras Corporation · 4. First Access Sports · 5. Athletes First · 6. A sports agent is the foremost representative for amateur or professional athletes. Being a sports agent is an exciting career! Sports agents handle athletes' employment with a team and endorsements with corporations in exchange for a small percentage of the athlete's. SMWW Sports Agency. Sports Management Worldwide is an international full-service sports agency with an extensive network of Agent Advisors serving athletes. The agent's role is to help manage the athlete's career by negotiating the best deals possible for the athlete. Agents are responsible for. Top 27 Professional Athlete Management Companies · 1. Octagon · 2. Excel Sports Management · 3. Boras Corporation · 4. First Access Sports · 5. Athletes First · 6. What is a sports agent? What do sport agents do? Sport agents also search for talented athletes. Their role is different from a coach or scout. Sports agents do. As a sports agent, I understand it is my responsibility to sit down with team owners, advertisers and entertainment personal to secure the best contracts. Our 8-week online Athlete Management Certificate Course prepares you for all parts of life as a sports agent. This course covers everything from signing your. Top 27 Professional Athlete Management Companies · 1. Octagon · 2. Excel Sports Management · 3. Boras Corporation · 4. First Access Sports · 5. Athletes First · 6. A sports agent is the foremost representative for amateur or professional athletes. Being a sports agent is an exciting career! Sports agents handle athletes' employment with a team and endorsements with corporations in exchange for a small percentage of the athlete's. SMWW Sports Agency. Sports Management Worldwide is an international full-service sports agency with an extensive network of Agent Advisors serving athletes. The agent's role is to help manage the athlete's career by negotiating the best deals possible for the athlete. Agents are responsible for. Top 27 Professional Athlete Management Companies · 1. Octagon · 2. Excel Sports Management · 3. Boras Corporation · 4. First Access Sports · 5. Athletes First · 6.

Sports Agent Certification Licensing of sports agents and managers starts at the league level. Each league has its own agent qualification, testing and. Formed in , Sports Management Group, Inc. (SMG) provides contract negotiations, financial management, marketing and endorsement programs for professional. But, the thing that truly distinguishes us is the level of professionalism of our people. Our agents are professionals who may well be the most qualified in. Sports Agent Job Description Sports agents represent and promote amateur and professional athletes when dealing with prospective teams or inclusions in. SMWW Agent Advisors can recruit and represent athletes on behalf of Sports Management Worldwide in a variety of sports, and share equally in any commission fee. Being a sports agent is an exciting and rewarding career. You get to find talented athletes and help them grow. The job can include a variety of interesting. Sports managers, sports agents, and sports attorneys aren't the same thing. There are slight and huge differences between the responsibilities of these three. Optimal Sports Management is dedicated to enhancing the lives of our clients, both on and off-the field, by giving them the necessary resources to not only. A sports agent is a legal representative (hence agent) for professional sports figures such as athletes and coaches. They procure and negotiate employment. Sports agents work to place professional athletes with teams and negotiate contracts on behalf of the athletes they represent. Apply here for a sports agent in football, soccer, basketball, cricket, hockey, racing, rugby, baseball. The primary difference between a sports agent and a sports manager is that a sports agent negotiates contracts on behalf of their clients. Sports agents often. With a passion for sports, many career options exist aside from agents. Sports management careers might include the management of front offices in sports. Sports agents act as business managers for athletes and represent them in contract negotiations and managing their finances. Most professional sports leagues require that all player agents and managers have at least a bachelor's degree. National Football League (NFL) agent. 1. Sports Management. If you're interested in being an agent, this is one of the most relevant and helpful degrees you can pick. · 2. Business · 3. Kinesiology · 4. The main difference is in the scope of the agent's and manager's roles. Managers oversee the entire business side of the career, while agents focus more. Sports agents represent amateur and professional athletes in contract and salary negotiations. Find out about the education, licensure and certification. Unlike the sports manager, who is employed by a single team, organization, or individual to accompany them through their careers, the sports agent often. Costs range from $ to more than $1, Exams are typically held once per year. Pass the league's sports agent exam, and pay another fee to the league before.

What Do The Different Fico Scores Mean

.jpg?format=1500w)

FICO has more than 50 different versions of your score that it sends to lenders. The score may change, depending on which company asks and what was important to. What FICO® Scores in this range mean. Page 9. 6. You have more than one FICO FICO® Scores are calculated from many different pieces of credit data on your. A higher FICO Score represents a greater likelihood that you'll pay back your debts so you are viewed as being a lower credit risk to lenders. Credit history: FICO uses trending data, which looks at the 24 month history, payments, lates, balances and pulls that into the score at the time the scores are. FICO® Scores are numbers that summarize your credit risk. Scores are based on a snapshot of your credit file at particular consumer reporting agencies at a. Scores range from to We'll discuss how the FICO scoring model is radically different below. According to Credit Sesame, there are five categories. A FICO score ranges from to and is used by lenders to assess borrowers' creditworthiness. Created by the Fair Isaac Corporation (FICO). Credit scores are not meant to be absolute predictors of whether someone is going to default on their credit payments or not. Rather, they're used by lenders. There are two types of inquiries — “hard” inquiries and “soft” inquiries — and FICO Scores only consider hard inquiries. A hard inquiry occurs when a lender or. FICO has more than 50 different versions of your score that it sends to lenders. The score may change, depending on which company asks and what was important to. What FICO® Scores in this range mean. Page 9. 6. You have more than one FICO FICO® Scores are calculated from many different pieces of credit data on your. A higher FICO Score represents a greater likelihood that you'll pay back your debts so you are viewed as being a lower credit risk to lenders. Credit history: FICO uses trending data, which looks at the 24 month history, payments, lates, balances and pulls that into the score at the time the scores are. FICO® Scores are numbers that summarize your credit risk. Scores are based on a snapshot of your credit file at particular consumer reporting agencies at a. Scores range from to We'll discuss how the FICO scoring model is radically different below. According to Credit Sesame, there are five categories. A FICO score ranges from to and is used by lenders to assess borrowers' creditworthiness. Created by the Fair Isaac Corporation (FICO). Credit scores are not meant to be absolute predictors of whether someone is going to default on their credit payments or not. Rather, they're used by lenders. There are two types of inquiries — “hard” inquiries and “soft” inquiries — and FICO Scores only consider hard inquiries. A hard inquiry occurs when a lender or.

There are many different versions of the FICO score based on different scoring models. FICO scores use information in your credit report to help determine your. A FICO Score is a popular credit score that lenders use to help determine a consumer's overall credit risk. It is based on an individual's payment history. A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. What Does a FICO Score Really Mean? Beyond assessing your creditworthiness Why Is My FICO Score Different From My Credit Score? If you've checked. A credit score of or above is generally considered good. A score of or above on the same range is considered to be excellent. It is a numerical estimate of a consumer's ability to repay borrowed in full and on time. The score is based on six main categories related to credit use. Most mortgage lenders will pull your scores from all three bureaus. For other types of credit, such as personal loans, student loans and retail credit, you'll. FICO scores range from to Higher scores are better. Most home buyers these days have a score above FICO makes a big difference. What does this mean for you? If you're new to credit or haven't used your credit accounts in a while, you may not have a FICO credit score, but you may have. FICO has more than 50 different versions of your score that it sends to lenders. The score may change, depending on which company asks and what was important to. A FICO score provides lenders with an indication of your ability to pay back debt. The higher your score, the less of a risk you represent to the lender. There are many types of FICO scores as each FICO uses a different score model, for example FICO8, FICO 4, etc. each uses a different formula. A FICO Score is a popular credit score that lenders use to help determine a consumer's overall credit risk. It is based on an individual's payment history. Scores range from to We'll discuss how the FICO scoring model is radically different below. According to Credit Sesame, there are five categories. The two most widely used types of credit scores are FICO Score and VantageScore. On this page. What are the different credit scoring models? Why do I have so. Yes, there are three main types of credit scores: FICO® scores, VantageScore®, and insurance scores. In each case, your credit score is a three-digit number. Credit scores typically fall in one of the credit score ranges that determine if your credit is excellent, good, fair or poor. Learn how to take your score. FICO scores generally range from to , where higher scores display lower credit risk and vice versa (note: some types of FICO scores have a slightly. FICO Scores have been an industry standard in helping lenders and creditors evaluate their customers' latest version of their credit profile to know if they are.

How Much To Manage Instagram Account

You can add up to 5 Instagram accounts and quickly switch between them without having to log out and log back in. Here's how to manage multiple instagrams. SocialPilot is a social media Scheduling and Management tool that helps agencies and brands to grow their presence on social media. Starting February , an Apple service fee of 30% of your total ad payment, before any taxes and local fees, may apply when you boost in the Instagram iOS. How to Change Instagram from Business to Personal (Step by Step!) · Open the Instagram App · Go to your Instagram Business Profile · Tap the menu button in the. Loomly is a social media management platform that empowers marketing teams to grow successful brands online through collaboration, publishing, & analytics. Discover why we're the top-rated social media management tool for growing teams. Start your free trial. No credit card needed. Discover what businesses can do on Instagram. Get your businesses started and learn how you can create a free business account. Over 2 million businesses connect with people on Instagram. Learn how to use Instagram to reach new customers, grow your audience and engage with existing. There are a lot of moving cogs when it comes to what determines the success of an Instagram account. Having a solid strategy based on the time or frequency you. You can add up to 5 Instagram accounts and quickly switch between them without having to log out and log back in. Here's how to manage multiple instagrams. SocialPilot is a social media Scheduling and Management tool that helps agencies and brands to grow their presence on social media. Starting February , an Apple service fee of 30% of your total ad payment, before any taxes and local fees, may apply when you boost in the Instagram iOS. How to Change Instagram from Business to Personal (Step by Step!) · Open the Instagram App · Go to your Instagram Business Profile · Tap the menu button in the. Loomly is a social media management platform that empowers marketing teams to grow successful brands online through collaboration, publishing, & analytics. Discover why we're the top-rated social media management tool for growing teams. Start your free trial. No credit card needed. Discover what businesses can do on Instagram. Get your businesses started and learn how you can create a free business account. Over 2 million businesses connect with people on Instagram. Learn how to use Instagram to reach new customers, grow your audience and engage with existing. There are a lot of moving cogs when it comes to what determines the success of an Instagram account. Having a solid strategy based on the time or frequency you.

Log into your Instagram account. · Tap profile · Tap more options · Tap Accounts Center. · Scroll down and tap Accounts. · Tap Remove next to the profile you'd like. Instagram lets you manage 5 active accounts per device. Also, make sure you don't opt in to remember your accounts' passwords so that you can log in to the 6th. Add social media links · Go to your Business Profile. Learn how to find your profile. · Click Edit profile and then Business information and then · To edit. Save time scheduling, analyzing, and managing your social media and ad content. Create your FREE account and grow your business presence. Add people to your Business Manager. If you're using Business Manager to manage Page roles, you'll need to assign roles in Business Manager. Hot Tip #3: Want to save time on managing your Instagram content? Here's how to schedule Instagram posts! Hot Tip #4: Need tools to get the most from Instagram? Increase Instagram followers and manage your account effectively. Gain more followers and boost your Instagram account productivity with Combin. Only people with full control of the business portfolio can add Instagram professional accounts to the portfolio. If your Instagram professional account is. managing your account, including insights, promotions, and account settings. Finally, too much switching back and forth between accounts can cause Instagram. Instagram Ads' laser-focused targeting capabilities helps you reach your audience with the right offer at the right time and urges users to spring into. Over 2 million businesses connect with people on Instagram. Learn how to use Instagram to reach new customers, grow your audience and engage with existing. Create, buy and manage Instagram campaigns. If If your business already has an Instagram account, you can claim it when creating your ad in Ads Manager. In Commerce Manager, you can set up and customize your shop, manage your catalog, create collections of featured items, view shop insights and more. Social Media Management. Too busy? Let a social media management expert handle your accounts for you. How it works. If your Instagram posts feature music you don't have permission to use on Pinterest, it will be muted. Learn more in our article on how to add music to Pins. Using a social media management program like Hootsuite is one of the simplest methods to handle many Instagram profiles. It also makes working. See how much time their child is spending on the app (total, average Instagram ensures that users can control and manage all comments on their pages. How to Change Instagram from Business to Personal (Step by Step!) · Open the Instagram App · Go to your Instagram Business Profile · Tap the menu button in the. You can add up to 5 Instagram accounts and quickly switch between them without having to log out and log back in. Here's how to manage multiple instagrams. With Hootsuite, you can manage multiple accounts—such as five Instagram Hootsuite Enterprise has allowed us to respond to social media crises much more.

How Much Does It Cost To Replace Old Electrical Wiring

Replacing other devices like outlets, switches or fixtures could cost between $25 and $ per device. Dedicated circuits for larger appliances could cost. How Much Does It Cost to Install or Replace a Carpet? Electrical prices average from $ to install a switch, $ to install an outlet, $ to install a. The quantities of circuit breakers, outlets, and switches are estimated for a standard house, with costs of $, $, and $ per unit, respectively. As with anything your electrical wiring will gradually experience wear and tear, especially with the high electricity demands in the average modern home. Over. But on average, you can expect to spend between $3, and $ to rewire a medium-sized home. In this guide, we look at the different factors that will impact. The cost to replace wiring in an old house typically ranges from $8, to $15, for a 1, to 3,square foot home. This expense generally covers both. Wiring costs approximately $8 to $10 per square foot. Rewiring your whole house if required costs the average Canadian homeowner between $3, and $10, The basic cost to Re-Wire a Home is $ - $ per residence in August , but can vary significantly with site conditions and options. Rewiring is typically done by a licensed electrician who strips out the old wiring and runs new wiring throughout the entire house, installs a new circuit. Replacing other devices like outlets, switches or fixtures could cost between $25 and $ per device. Dedicated circuits for larger appliances could cost. How Much Does It Cost to Install or Replace a Carpet? Electrical prices average from $ to install a switch, $ to install an outlet, $ to install a. The quantities of circuit breakers, outlets, and switches are estimated for a standard house, with costs of $, $, and $ per unit, respectively. As with anything your electrical wiring will gradually experience wear and tear, especially with the high electricity demands in the average modern home. Over. But on average, you can expect to spend between $3, and $ to rewire a medium-sized home. In this guide, we look at the different factors that will impact. The cost to replace wiring in an old house typically ranges from $8, to $15, for a 1, to 3,square foot home. This expense generally covers both. Wiring costs approximately $8 to $10 per square foot. Rewiring your whole house if required costs the average Canadian homeowner between $3, and $10, The basic cost to Re-Wire a Home is $ - $ per residence in August , but can vary significantly with site conditions and options. Rewiring is typically done by a licensed electrician who strips out the old wiring and runs new wiring throughout the entire house, installs a new circuit.

If the electrician needs to cut through drywall—and later replace it—that can add to the cost of your home rewiring. Upgrades To Amperage. Older homes often. How Much Does It Cost To Get A House Rewired? · Basic house rewire cost: $3, to $4, · Regular house rewire cost: $4, to $10, · Advanced house rewire. If your older home was built with aluminum wiring for its electrical system, it's no secret that it should be replaced. Although aluminum wiring was once. Many older model homes have aluminum wiring, which if not properly How Much Does It Cost to Install a Whole-Home Humidifier in Denver? How Much. For a new service and to fish wires I'd say no less than 10–12k.. and that's being conservative could be closer to 20K depending on the size of the house. Copper wiring may cost anywhere from $ to $, depending on the length and installation. The hourly rate of an electrician ranges from $35 to $ per hour. The cost of upgrading your existing electrical service panel to a or amp panel is $ to $3, Most Popular Home Maintenance Tips. 17 Things to. If you suspect the wiring in your home may need updating, you are likely wondering about the cost to rewire a house. According to Angie's List, the average cost. The average cost of a rewiring permit is CAD to depending on your local authority rates. Wiring a New House Is Easier Compared to an Old House. The. The basic cost to Replace an Electrical Outlet is $ - $ per outlet in April , but can vary significantly with site conditions and options. According to zetflix-mirror.ru the average cost for rewiring a sq ft home can be as low as $1, and as high as $30,, with. The basic cost to Install Electrical Wiring is $ - $ per wiring run in August , but can vary significantly with site conditions and options. Rewiring a medium-sized house can cost between $8, and $15, The complexity of the project and accessibility of the wiring can affect the final price. 3. For example, if it would actually cost a licensed electrical contractor in Ontario $10, to replace knob and tube wiring, many buyers would estimate the cost. For a small house, the average cost of a rewiring project in Calgary is between $1, and $4,, factoring in the crucial variables. To rewire a house. Some rewiring projects might require you to open up walls to reach and remove old wires and install new ones. This can increase the total project costs. Budget. Electrical wiring costs will vary based on project. The number of fixtures, receptacles and switches should all be taken into consideration when forming your. On average, though, you might expect to pay between $1, to $10, For a smaller home, the cost could be at the lower end of this range. For larger homes or. The national average cost to wire a new house is between $5, and $12, The average homeowner needs to pay $10, for new wiring, panel, outlets, and. A wiring upgrade on a small home that has been gutted to its studs might cost less than $4, while rewiring a larger or finished home could cost $10, or.